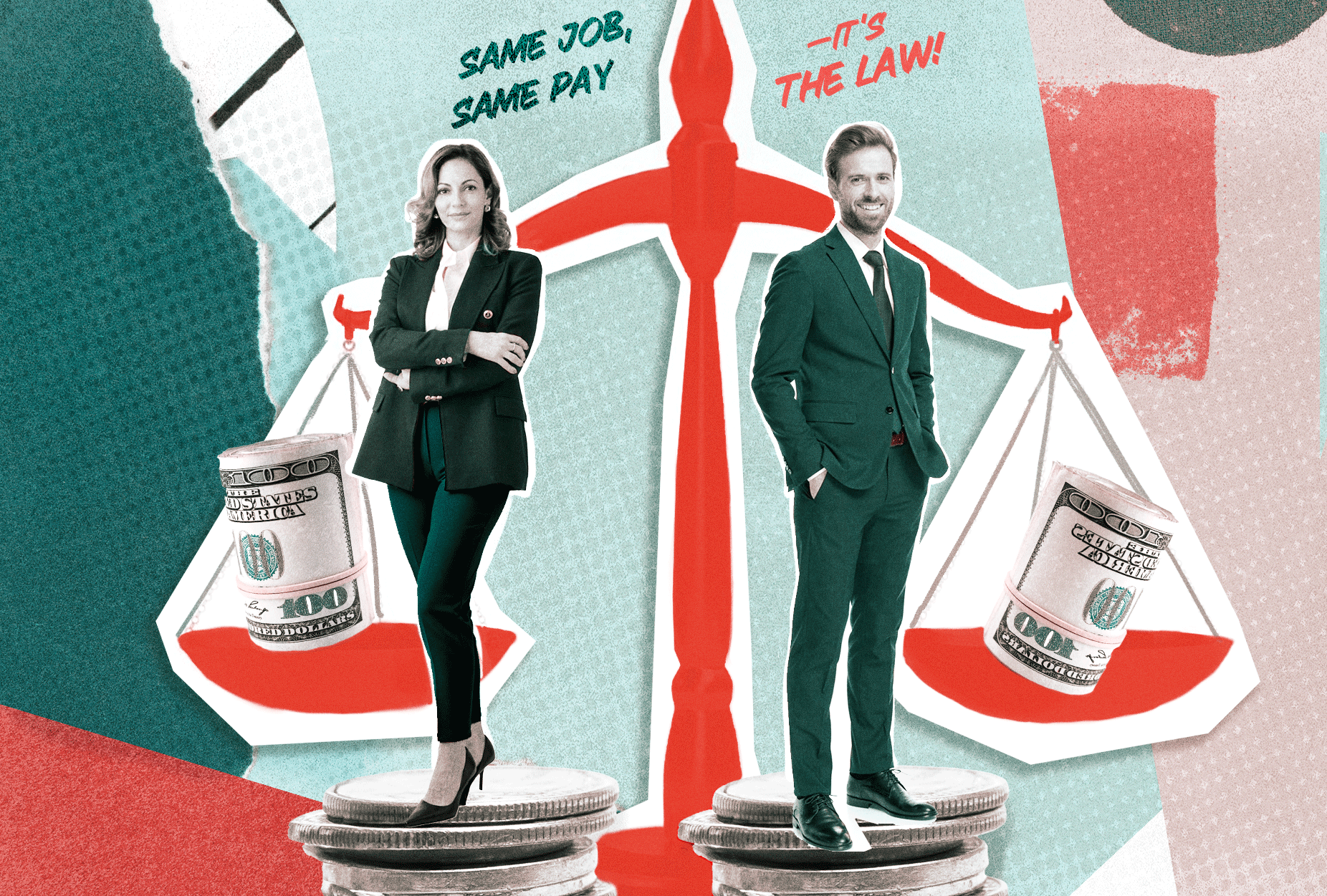

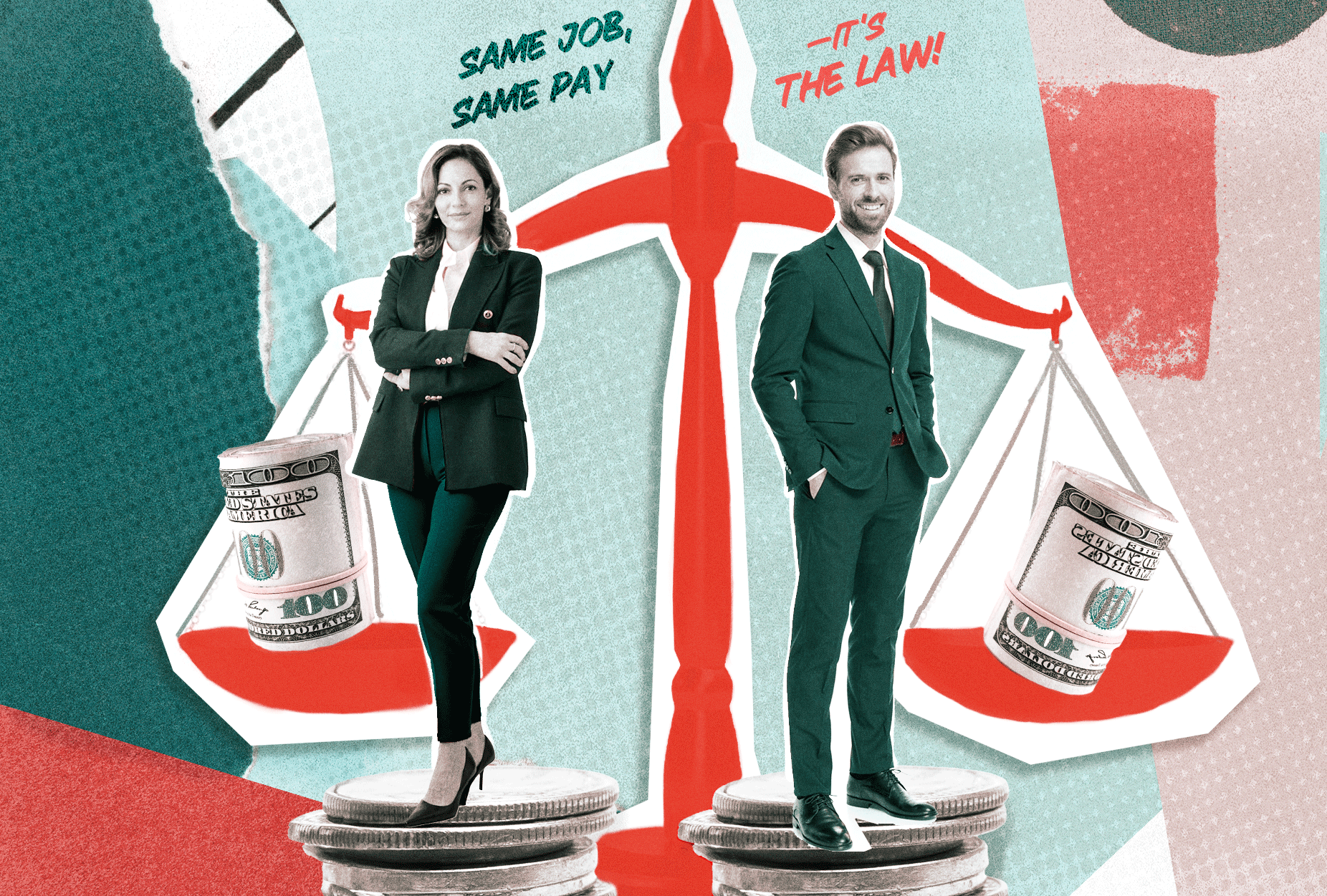

6 Takeaways From California’s Equal Pay Act

Women have earned less than men for doing the same job for decades. The Federal Equal Pay Act works to close the wage gap between genders by requiring that women and men in the same workplace get the same pay for performing the same work.

The Equal Pay Act covers every type of pay, including:

- Salary

- Overtime pay

- Vacation and holiday pay

- Bonuses

- Benefits

- Life insurance

- Cleaning or gasoline allowances

- Profit sharing

- Stock options

- Reimbursement for travel expenses

- Hotel accommodations

In other words, if an employer offers vacation and holiday pay to one person, they must also offer it to all others who are working similar jobs without discrimination.

California’s Equal Pay Act does even more to ensure equal pay – across genders and races. Our employment lawyers would like to share some of the most important aspects of this state law.

6 Things All Workers Need to Know about California’s Equal Pay Act

Also known as Labor Code section 1197.5, California’s Equal Pay Act became effective on January 1, 2016. Here are 6 other important facts about the law.

1. Work Must Be “Substantially Similar”

Jobs don’t have to be exactly the same, but they need to be substantially similar in the eyes of California’s Equal Pay Act.

Substantially similar work requires workers to put nearly the same effort into the work, have similar skills, and take on equal responsibilities under the same conditions. In other words, employees who work similar jobs receive similar pay.

2. Employers May Be Able To Pay Some Workers More

If an employer can justify it when challenged, they may be able to give some workers a higher salary or wage.

Factors that can justify higher pay include:

- A merit system, such as getting points for the quality of their work or for volunteering for holiday shifts

- A seniority system that pays workers more the longer they stay at the workplace

- A system that establishes earnings by the quantity or quality of work

- A bona fide factor other than gender, such as education, training, or experience

3. Employers Must Keep Records

California’s Equal Pay Act requires employers to maintain records of:

- Wages and wage rates

- Job classifications

- Any relevant terms and conditions of employment that can affect pay

Employers must keep these records for three years.

4. Underpaid employees can take legal action to recover wages

Employees who did not receive the equal pay they were entitled to can file a claim against their employer. If they win, they can recover their lost wages, along with any interest owed, damages, costs of the lawsuit, and reasonable attorney’s fees.

5. But They Have To Act Fast

California’s Equal Pay Act has a statute of limitations, which means workers in California have a limited time to file a claim. More specifically, the statute of limitations is two years after the worker received unequal pay. However, if the employer knowingly broke the law by paying some employees more than others for the same work, the statute of limitations is three years.

6. Employees May Now Discuss Their Wages Openly

Prior to the state’s Equal Pay Act, employers could prevent their workers from knowing whether they were being paid equally or not. Now, employees can tell others how much they make, discuss how much other workers make, ask about other employees’ wages, or help others exercise their rights to talk about their pay.

Has Your Boss Paid You Less Than Others Who Do Similar Work At Your Job? Contact Your California Employment Lawyer At D.Law!

According to California’s Equal Pay Act, you deserve the same pay as others who do a similar job at your workplace. If you have been getting less pay than you deserve, contact D.Law. Our employment attorneys have helped hundreds in California with employment law and workers’ rights for people in the Bay Area, San Diego, Fresno, Los Angeles, and other CA cities.

Ready to get started?

Contact us now for a free consultation to find out how we can help you.